hawaii general excise tax id number

Gross receipts are total business income before any business expenses are deducted. Hawaii general excise tax id number Saturday March 12 2022 Edit If you have quetions about the online permit application process you can contact the Department of Taxation via the sales tax permit hotline 800 222-3229 or by checking the permit info website.

How To Register For A Sales Tax Permit In Hawaii Taxvalet

Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits.

. General Excise Tax License Search. General Excise GE 07420. For more information see Tax Facts No.

GET TAT Hawaii Tax Calculation Example. 10000 x 1025 102500 TAT due. All businesses must obtain a Hawaii Tax Identification Number HI Tax ID and all required tax licenses.

The Form BB-1 which must be submitted through Hawaii Business Express can be used to register for an ID card online and get one. Gross rent from Transient Accommodation Rentals. Withholding WH 20070.

Check out the rest of this guide to find out who needs a General Excise. GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type. Tax Services Hawaiʻi Tax Online.

You should not enroll in AutoFile using a Hawaii Tax ID that begin with abbreviations for other tax types such as CO FR GS PS. Individual Income 01201. You can find information on Hawaii Tax IDs in item 12 to 19 of Hawaiis Tax Facts publication.

Gross rent from Other Rentals. 37-1 General Excise Tax GET and Tax Announcement Nos. You may pay the following tax types- 04610.

The GET is similar to a sales tax but is actually a privilege tax based on the gross income of most business activities in the State of Hawaii. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use. Rental Vehicle RV 01311.

2006-15 General Excise Tax GET and County Surcharge Tax CST Visibly Passed on to Customers 2018-14 Kauai County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on the Customers 2018-15 Hawaii. GE Taxable income. Initially the Hawaii Tax ID consists of two letters identifying the account type followed by 12 numbers.

A general exciseuse and county surcharge tax account type is designated by the letter GE. For more information visit the Department of Taxations website at taxhawaiigov TAX FACTS 37-1 General Excise Tax GET This Tax Facts answers common GET questions. TA Taxable income.

Check on whether a business or individual has a general excise tax license with the State of Hawaii Department of Taxation. Find resources for Government Residents Business and Visitors on Hawaiigov. If you are stopping your business temporarily you can request to put your general excise tax transient accommodations tax rental motor vehicle tour vehicle and car-sharing vehicle surcharge tax and withholding tax licenses on hold using Form L-9An account may be put on Inactive status for up to two 2 years.

37-1 General Excise Tax GET and Tax Announcement Nos. It offers a number of online resources for consumers including licensee status and licensing complaints tax and business registration and other educational materials. 20942 10K 10K 20K rent 942 GET collected x 45 94241 GET due.

3 rows Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format. An extension for an additional two 2 years may be. Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation.

Transient Accommodations TS 01130. Individual Estimated 02230. The General Excise Tax license is obtained through the Hawaii Department of Taxation as a part of applying for a Hawaii Tax Identification Number.

Businesses are subject to GET on their gross receipts from doing business in Hawaii.

Hawaii General Excise Tax Everything You Need To Know

A Fairly Thorough Explanation Of Hawaii General Excise Tax Get For Beginners 2019 Youtube

Sales Tax Tuesday 2018 Hawaii Special Edition Insightfulaccountant Com

Hawaii State Tax Golddealer Com

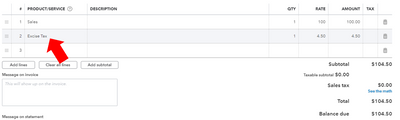

Since Hawaii S Gross Excise Tax Is Not A Sales Tax Does Qb Have Hawaii Version Or Can You Tell Me How To Set This Up In Qb

County Surcharge On General Excise And Use Tax Department Of Taxation

How To File And Pay Sales Tax In Hawaii Taxvalet

Licensing Information Department Of Taxation

Hawaii General Excise Tax Everything You Need To Know

Rates And Availability At Kihei Akahi Dg13 Maui Vacation Rental Condo

General Instructions For Filing General Excise Use Tax Hawaii Gov

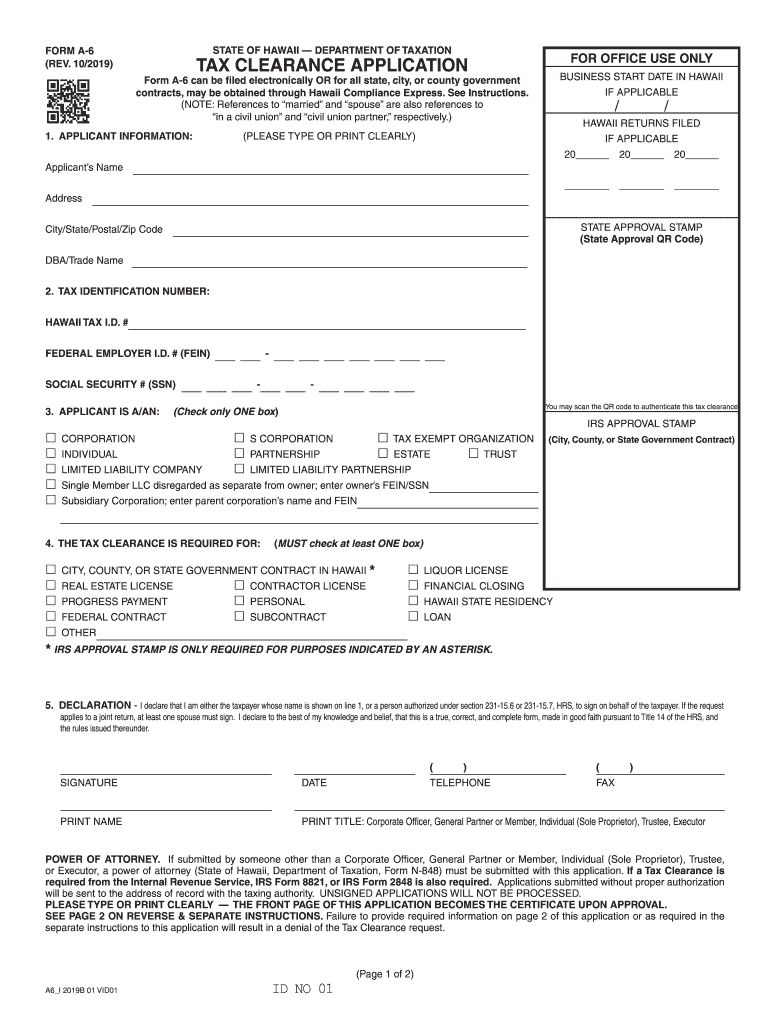

Hi Dot A 6 2019 2022 Fill Out Tax Template Online Us Legal Forms